Death Penalty To Women/Child Traffickers, The Lion Is Awake,The Strikes Will Be Hard & Fast – Ep. 3121

Podcast: Download (Duration: 1:42:59 — 44.1MB)

Watch The X22 Report On Video

The [CB]/[WEF] are now using what they learned from covid and use it with climate change. This will fail. The Biden admin are pushing the green new deal as hard as they can. Trump sends another solution to the people. [CB] prepares the [CBDC] but the people are already rejecting it. The [DS] is panicking, they realize the people are seeing their system and they can’t stop it, they tried to take back the narrative but this has failed. The treasonous crimes they committed is now being exposed.Trump sends message to the [DS], traffickers will be executed. The lion is awake and the lion is going to show the jackals who the king of the jungle is, the strike will be hard and fast.

The [CB]/[WEF] are now using what they learned from covid and use it with climate change. This will fail. The Biden admin are pushing the green new deal as hard as they can. Trump sends another solution to the people. [CB] prepares the [CBDC] but the people are already rejecting it. The [DS] is panicking, they realize the people are seeing their system and they can’t stop it, they tried to take back the narrative but this has failed. The treasonous crimes they committed is now being exposed.Trump sends message to the [DS], traffickers will be executed. The lion is awake and the lion is going to show the jackals who the king of the jungle is, the strike will be hard and fast.

Economy

What did this Justin Trudeau just say?

He said we learned from the COVID crisis and will apply it to the climate crisis?? 🔥🔥🔥

— Wall Street Silver (@WallStreetSilv) July 19, 2023

- The Biden regime’s radical “climate change” kicked into another gear and hoped you would not notice.

- The Department of Energy (DOE) released a harmful new rule which will make it far more burdensome for Americans to do laundry, clean, and cook. Millions may also get to experience the “joy” of freezing showers as well.

- The Regime is lying about this reality and claims, without evidence, that consumers will achieve significant cost savings. Energy Secretary Jennifer Granholm released the following statement following the latest assault on ordinary Americans:

- Today’s actions — together with our industry partners and stakeholders — improve outdated efficiency standards for common household appliances, which is essential to slashing utility bills for American families and cutting harmful carbon emissions.

the truth is this scheme will actually force cheaper water heaters off the market and limit choices for American customers. Given the crushing impact Biden’s policies are having on American workers, millions will likely be unable to afford to buy a new one.

- Specifically, non-condensing gas-fired water heaters will soon no longer be available. While these are supposedly less efficient, they come with lower installation costs for consumers because they are smaller and cheaper.

- Instead, the Regime wants to require higher efficiency for heaters using heat pump technology. In the case of gas-fired water heaters, efficiency gains would ostensibly be achieved through condensing technology.

- You will suffer while they brag to their globalist masters about how their “energy efficient” schemes supposedly cut carbon emissions.

Sources: thegatewaypundit.com

Study accidentally proves man-caused global warming not provable

- According to a study recently published in the journal Science, and latched onto by USA Today, more than 400,000 years ago, Greenland was actually green. Yes, scientists say, the massive island was an ice-free landscape and was perhaps even covered with trees.

- This is important to know, avers study co–lead author Paul Bierman of the University of Vermont, because it tells us that “Greenland’s ice sheet is fragile.” Bierman stated: “All by itself, during a warm period very similar to today, the ice sheet melted away 400,000 years ago. That was without fossil fuel emissions into the atmosphere.”

- An ice sheet melted “all by itself”? Here is a “scientist” telling us that we must immediately change our lifestyles and bankrupt our economies to prevent something that occurred naturally and without human influence 400,000 years ago!

- After Greenland’s ice sheet turned to water, whined the climate alarmists, the sea level rose at least five feet.

- This caused

the fish-wrap factoryUSA Today to solemnly observe: “This means that the ice sheet on Greenland may be more sensitive to human-caused climate change than previously thought — and will be vulnerable to irreversible, rapid melting in the coming centuries.” - Say what?! No, it means that the ice sheet on Greenland was provably sensitive to non-human-caused climate change (warming)…and that the melting is reversible…because that is exactly what occurred after the last melting, and why Greenland is more frozen than green today!

- Bierman, who asserted that the study “is a real warning sign to us that we’re going to lose large parts of the ice sheet unless we decarbonize.” Nope. It tells us that we may lose large parts of the ice sheet no matter what we do…or don’t do.

- Or not.

Source: americanthinker.com

Biden admin proposes new rule to jack up prices for oil and gas leases

- The Biden administration unveiled a new oil and gas leasing rule proposal that would jack up prices at nearly every stage of the public land leasing process.The Bureau of Land Management (BLM), a subagency of the Department of the Interior (DOI), issued the rule proposal Thursday in an effort to adopt a “more transparent, inclusive and just approach” to federal oil and gas leasing on public lands and “[provide] a fair return to taxpayers,” The rule nominally aims to boost land conservation efforts, but it would do so by massively increasing minimum bid thresholds and required per-acre fees for energy interests and developers to pay. The American Petroleum Institute slammed the rule proposal, calling it “yet another attempt to add even more barriers to future energy production” and “a concerning approach from an administration that has repeatedly acted to restrict essential energy development,” according to a Thursday press release.The minimum required lease bond that developers must pay would jump from $10,000 to $150,000, and the required statewide bond would spike from $25,000 to $500,000, according to the rule proposal. The rule would also raise the minimum royalty fees that developers have to pay from 12.5% to 16.67%.Additionally, the rule will boost the minimum per-acre leasing bid thresholds from $2 to $10 if finalized, with the minimum rising to match future inflation after 10 years. The rule proposal also seeks to impose yearly per-acre rental fees of $3 for two years, then $5 for the next 6 years and then $15 for every subsequent year after that.Source: wnd.com

- borrowers who must resume loan payments after the Supreme Court struck down President Biden’s student debt forgiveness program will be shelling out $300 per month each on average, according to number-crunching from consumer data firm Earnest Analytics.

- Some 25.5 million consumers, or 60% of those with student debt, took advantage of forbearance provisions in the pandemic-related CARES Act, per the report, citing College Board numbers.

- Like other analysts, Earnest researchers warn that, “With interest resuming in September and payments in October, a $300/month bill on many consumer budgets may add pressure to an already cautious spending environment.”

- According to the Earnest report, those with higher market share among borrowers who had been able to suspend payments include Peloton, Ikea, Ashley, HomeGoods, Wayfair, Lowe’s, and most apparel and department stores. Specifically, Old Navy had the highest share at 14%, while Nordstrom’s full price business had the lowest share at 8%, Earnest found.

Source: retaildive.com

Most voters approve of the Supreme Court’s recent ruling that declared President Joe Biden’s student loan debt cancellation unconstitutional.

More At Rasmussen Reports: https://t.co/bFU26Qmqwv pic.twitter.com/5GjCNLqimo

— Rasmussen Reports (@Rasmussen_Poll) July 23, 2023

- Must start now!

Donald J. Trump@realDonaldTrump

Rescuing America’s Auto Industry from Joe Biden’s Disastrous Job-Killing Policies! #AGENDA47

- FedNow is live at 35 banks.

- Axios reports that 35 banks across the country are participating in the launch.

- By the numbers: So far, 35 banks have signed up as early adopters of FedNow, including JPMorgan Chase and Wells Fargo, but notably not including Citigroup or Bank of America. That number is rather lower than the Fed led us to believe as recently as recently as June.The U.S. Treasury is also signed up as an early adopter of FedNow.In order to use either service, both the sending and the receiving bank need to be signed up for the system.

- But now, the early infrastructure is in place for CBDCs.

Source: zerohedge.com

The Federal Reserve is building the financial equivalent of the Death Star.

Central Bank Digital Currency (CBDC) corrupts money into a tool for coercion & control.

Congress must swiftly ban then criminalize any effort to design, build, develop, test or establish a #CBDC. pic.twitter.com/9JWiyj5H2f

— Warren Davidson 🇺🇸 (@WarrenDavidson) July 23, 2023

BRICS leaders to discuss sustainable payment mechanism – Moscow

- According to the Russian Foreign Ministry, the use of national currencies in mutual trade is complicated by factors such as their limited convertibility and higher volatility compared to the US dollar. The ministry also acknowledged that the potential creation of a new BRICS single currency would be a “delicate” process.

- The BRICS nations have been seeking to shift further from the US dollar in mutual trade, with the de-dollarization trend gaining momentum following sanctions that effectively cut Russia off from Western financial mechanisms. Numerous developing nations – including Russia’s fellow BRICS members China, India, Brazil and South Africa – have started to move toward alternative currencies in trade.

- Source: rt.com

✨ Wrong at $2K, wrong today. #Bitcoin pic.twitter.com/RwRhAvZHgO

— RIZZO (@pete_rizzo_) July 23, 2023

JUST IN: Total #Bitcoin supply held by long-term HODLers is at an ALL TIME HIGH 🚀 pic.twitter.com/AqfS3L5bjc

— Bitcoin Magazine (@BitcoinMagazine) July 21, 2023

Political/Rights

- A higher proportion of millennials believe referring to a transgender person using incorrect pronouns should be considered a criminal offense

- Among those aged 25-34, 44 percent support the idea of misgendering being a criminal offense, while only 31 percent disagree

- The issue of transgender rights and its implications on women’s rights has become a contentious political topic across the United States

DEI is systemic racism in its purest form and big companies are finally getting rid of it

Netflix, Disney and WB have recently fired DEI execs and headhunters say demand for these senior roles is lowest in 30 years

Here’s why – after SCOTUS abolished affirmative action in… pic.twitter.com/07MpaHb2bk

— DC_Draino (@DC_Draino) July 21, 2023

- According to a recently released court opinion, FBI officials illegally accessed a foreign intelligence database to search for information on a U.S. Senator, a state senator, and a state-level judge.

According to the opinion from the Foreign Intelligence Surveillance Court, an analyst with the FBI conducted four searches of the intelligence database using the last names of a U.S. Senator and state senator in June of 2022 — both of whom were not named in the filing.

The analyst “had information that a specific foreign intelligence service was targeting” both legislators, but a review of the search by the Justice Department’s National Security Division determined that the search still didn’t meet the proper standards because they weren’t sufficiently tailored.

In a separate instance last October, an FBI specialist ran a search of the 702 database using the social security number of a state judge who “had complained to FBI about alleged civil rights violations perpetrated by a municipal chief of police,” the filing says, that also didn’t meet sufficient standards.

Here’s the actual court opinion where this abuse of the system is mentioned.

- In this case, we do not know who the U.S. Senator is who was spied on, though they have been notified. The state senator and the state-level judge are still in the dark and haven’t been made aware, per the report.

- Astonishingly, FBI Dir. Christopher Wray actually used the news that his agency spied on a U.S. Senator to proclaim how much progress they’ve supposedly made. No, I’m not kidding.

Anonymous ID: 871c6e No. 5476676

Q !!mG7VJxZNCI ID: 84ae7e No. 5476642

John Solomon and Amanda Head break down the top 7 Biden-Burisma bombshells from the FBI source document:

1. In 2014, Burisma Holdings hired Hunter Biden to influence his father, VP Joe Biden, in handling Ukraine's chief prosecutor investigating the company for corruption. Joe… pic.twitter.com/V0eBe693DI

— KanekoaTheGreat (@KanekoaTheGreat) July 21, 2023

Joe Biden successfully had the prosecutor fired by threatening to withhold $1 billion in loan guarantees.

2. Burisma informed the FBI informant that the Biden bribe money had illicit intentions or was part of a criminal scheme. 3. Burisma’s CEO believed he was “coerced” to hire Hunter Biden and considered it a package deal involving VP Joe Biden’s assistance. The total payment required was $10 million. JOHN SOLOMON: “Back in 2019, I got to interview Victor Shokin. And he was completely unaware of what the FBI was saying, but here’s what he told me. When President Poroshenko came to him, he said Joe Biden wants me to fire you. I don’t really have a reason, but I’m going to have to do it. He’s upset that you won’t stop investigating Burisma. Just think about that. That was mocked at the time, but now the FBI was being told something exactly the same and it wasn’t getting it from Shokin, but it was getting it from the owner of Burisma, Mykola Zlochevsky, and his top lieutenant. This was in the Fall of 2019 before the impeachment of Donald Trump. Keep in mind Donald Trump got impeached for asking Ukraine to investigate the things that the FBI now should have investigated. It’s pretty remarkable.”

4. The FBI informant confirmed that Burisma officials referred to Joe Biden as the “Big Guy,” supporting claims later made by Tony Bobulinski in 2020.

5. Burisma was concerned that the corruption probe into the company by Prosecutor Shokin would jeopardize their plans to acquire a US oil and gas firm and go public in America.

6. Burisma’s CEO and top official, Vadym Pozharskyi, acknowledged Hunter Biden’s lack of experience in the energy sector and were not impressed by his work, saying that he “was not smart.”

7. Burisma’s CEO boasted that tracking the $10 million payment to the Bidens would be extremely difficult and could take up to ten years to find the records. JOHN SOLOMON: “Finally, the FBI started receiving concerning information from this source about the Bidens and Burisma back on March 1, 2017, less than two months after Donald Trump had taken the presidency.

Think about that. We were all kept in the dark and when 2019 came around and people who reported on this were called conspiracy theorists, the FBI knew all along they had this sitting in their files. I think the most troubling thing even the agents who were supposed to investigate this case at the IRS weren’t told about this. Just think about that. Even the people who were investigating this were kept in the dark and if it weren’t for Chuck Grassley, we wouldn’t have known about it even today.”

QUESTIONS: Has the FBI investigated the Biden corruption allegations since March 2017? Why wasn’t the FBI source document given to the IRS agents investigating the Bidens? What actions did the FBI take during Donald Trump’s impeachment proceedings, considering the relevance of this information to the case? Why did Burisma pay Hunter millions if they thought he was inexperienced, not smart, and unimpressive in his work? Were the millions paid to Hunter by Burisma part of the bribe?

- Senator Chuck Grassley released the FBI document showing Joe Biden was involved in a $10 million bribery scheme with Burisma CEO Mykola Zlochevsky.

- The FD-1023 form alleged then-Vice President Joe Biden FORCED Zlochevsky, a Ukrainian oligarch, to pay himself and his son Hunter Biden a total of $10 million.

- According to the document, Biden’s bribery arrangement was described as “poluchili,” which is Russian crime slang for being “forced or coerced to pay.”

- Per the FD-1023:

According to the FBI’s confidential human source, executives for Burisma, a Ukrainian gas company, brought Hunter Biden on the board to “protect us through his dad, from all kinds of problems.” At the time, Burisma was seeking to do business in the United States, but was facing a corruption investigation in Ukraine, led by then-Ukraine Prosecutor General Viktor Shokin. Regarding that investigation’s impact on its ambitions in North America, Burisma CEO Mykola Zlochevsky reportedly said, “Don’t worry Hunter will take care of all of those issues through his dad.” Zlochevsky reportedly stated that he had to pay $5 million to Hunter Biden and $5 million to Joe Biden, an arrangement he described as ‘poluchili,’ which is Russian crime slang for being “forced or coerced to pay,” according to the document.

- Also, according to the document, Zlochevsky claims to have text messages and recordings that show he was FORCED to pay the Bidens to ensure Ukrainian Prosecutor General Viktor Shokin was fired.

Per the FD-1023:

Zlochevsky claimed to have many text messages and recordings that show that he was coerced into paying the Bidens to ensure Shokin was fired. Specifically, he claimed to have two recordings with Joe Biden and 15 recordings with Hunter Biden. Zlochevsky also retained two documents, presumably financial records, as evidence of the arrangement, but said he didn’t send any funds directly to the “Big Guy,” a term understood to be a reference to Joe Biden. References to the “Big Guy” surfaced in communications involving other Biden family business arrangements independent of the Burisma arrangement. Zlochevsky claimed it would take investigators 10 years to uncover the illicit payments to the Bidens, according to the document.

- Joe Biden publicly bragged about bribing Ukraine with $1 billion to fire Viktor Shokin, the Ukrainian Prosecutor General who was investigating Burisma corruption.

- I “said: I’m leaving in six hours. If the prosecutor is not fired, you’re not getting the money. Well, son of a bitch. He got fired,” Biden said in 2018.

WATCH:

🚨🚨🚨@ChuckGrassley just released the unclassified FBI FD-1023 form alleging VP Joe Biden was involved in a $5,000,000 bribery scheme.

IRS whistleblower Ziegler never received this form & under oath yesterday told @GOPoversight they potentially had corroborating evidence. https://t.co/GxCxm0NXTn

— Rep. James Comer (@RepJamesComer) July 20, 2023

My constitutional oversight responsibilities on this 1023 are to find out why FBI hid the doc from Congress & the American ppl for years/what steps were taken to investigate the info or was it swept under the rug??? FBI concealed info from House version to hide info WHY??

— Chuck Grassley (@ChuckGrassley) July 21, 2023

The FBI and DOJ have known for at least three years that Joe Biden is the "Big Guy."

— Tom Fitton (@TomFitton) July 23, 2023

- Mayor Eric Adams’ administration will begin warning illegal aliens at the United States-Mexico border not to travel and resettle in New York City, telling them that the cost of housing is high and that they are not guaranteed shelter or care.

- Since the spring of last year, more than 90,000 border crossers and illegal aliens have arrived in sanctuary New York City. The majority, about 55,000, are living off local taxpayers in city-run hotel rooms, shelters, and other facilities.

- Now, Adams has said his office will begin issuing fliers to border crossers and illegal aliens begging them not to travel to New York City — warning them about the high cost of living and housing prices and asking them to “please consider another city” to resettle.

Source: breitbart.com

- The report is titled “DHS Secretary Alejandro Mayorkas’ Dereliction of Duty,” and is part of the five-point Republican effort to build a case for impeaching Mayorkas:

Mayorkas is not an innocent bystander at the mercy of the federal bureaucracy, global events, or political opponents — he is the chief architect of the illegal immigration crisis that Americans have suffered through since January 2021.

He has either willfully sparked the current crisis through his extreme and irresponsible policies, or is such a poorly informed, inefficient, and inflexible leader that he is negligent in his duties. Either way, he has been derelict in his duty to secure the border, defend the homeland, and keep the American people safe, violating his oath to defend the Constitution and faithfully discharge the duties of his office.

source: breitbart.com

ABC News wrote a hit piece on the movie bringing awareness to child trafficking on the VERY SAME DAY it was announced 1 of their former senior producers would plead guilty to transportation & possession of child porn.

Starting to get why these news outlets hate Sound of Freedom? pic.twitter.com/uKUOlIG2SI

— Patri0tsareinContr0l (@Patri0tContr0l) July 21, 2023

Wow. @RepSwalwell and @BetoORourke campaigned for Stacie Laughton- the nation’s first transgender elected state rep who was arrested for child porn and child exploitation.

Worth noting that Stacie has a long criminal history dating back to before his 2022 campaign. pic.twitter.com/fRKskg3eht

— Libs of TikTok (@libsoftiktok) July 20, 2023

- Emails made public as part of a lawsuit by the Virgin Islands against JP Morgan Chase are undercutting a claim from Prince Andrew that he only saw convicted pedophile and alleged sex trafficker Jeffrey Epstein once after Epstein’s conviction.

- In 2019, Andrew told a BBC interviewer on the show “Newsnight” that the only time he saw Epstein after Epstein was released from jail after being convicted in a Florida case was in December 2010, to break off the friendship.

- Epstein died in 2019 in federal custody while facing sex trafficking charges. His death was ruled a suicide.

- However, in an email Epstein sent on June 14, 2010, to Jes Staley, Epstein’s contact at JP Morgan Chase, he wrote, “Andrew just sat next to me at dinner. We will try to connect this week. Any word on M? This is fun,” according to the Daily Mirror. The reference to “M” remains obscure.

-

- At the time, the publication noted, Epstein was still under house arrest at his Florida residence.

Source: thegatewaypundit.com

Geopolitical/Police State

- Robert F. Kennedy Jr. warned during a hearing on censorship at the House Weaponization Subcommittee that “a government that can censor its critics has license for every atrocity.”

- “A government that can censor its critics has license for every atrocity. It is the beginning of totalitarianism. There’s never been a time in history when we look back, and the guys who were censoring people were the good guys,” Kennedy replied.

Source: breigbart.com

- Democratic Congresswoman Stacey Plaskett, a non-voting delegate from the U.S. Virgin Islands, said the quiet part out loud while appearing on MSNBC’s ‘The Inside Interview’ with former White House mouthpiece Jen Psaki on Sunday.

- The U.S. government should define for America what the “truth” is and censor those Americans who don’t agree. Watch:

- “Well, you know, first of all, they wanna talk about censorship,” Plaskett said. “That anytime you point out untruths, you’re censoring, you’re stopping people from speaking. It’s not that we’re not stopping people from speaking [sic], people can speak, but we’re also going to give the American people the truth so that they can have science and facts and history against wild, outlandish claims that the Republicans are trying to get. That’s not only going to keep them from going to the polls or suppressing vote or telling untruths, but is also really very detrimental to the American people.”

- In other words, the U.S. government is going to stop people from speaking what Stacey Plaskett and her Democrat colleagues call “the truth.”

- A viral clip from the hearings showed Plaskett mouthing incorrect words from a transcript that was memorized and possibly written by her staffer.

Source: beckernews.com

Brazil's far left President Lula da Silva has just signed a decree limiting civilian access to firearms.

The parallels to America are striking. Lula gained power following a controversial election against conservative populist Jair Bolsonaro. There were accusations of voting…

— Charlie Kirk (@charliekirk11) July 21, 2023

irregularities and cheating, as Lula’s majority came entirely from the most corrupt, criminal parts of the country, while he lost everywhere else. Now, Brazil’s courts are trying to ban Bolsonaro from running for office again, and prosecutors want to shut down radio stations run by Bolsonaro supporters for spreading “misinformation.” And now, Lula is coming for their guns. Brazil is what liberal elites want for America: Tribal, expensive, sectarian, violent, and now less free than ever.

War

How it started. How it’s going. pic.twitter.com/QQ58rHlwC9

— David Sacks (@DavidSacks) July 22, 2023

- Visual representation of the Russian blockade in the Black Sea.

- Commercial ships have been warned if they attempt to port in Ukraine, they will be considered hostile and destroyed.

- Russia are constricting Ukraine economically and logistically.

- Ukrainian forces began firing US-provided cluster bombs on Russian forces in southeastern Ukraine.

- Using cluster bombs in battle is a war crime.

- J

Source: thegatewaypundit.com

NEW: Pres. Trump announces he will NOT support admitting Ukraine into NATO.

This is an obvious, yet crucial, step to avoiding global nuclear confrontation.

Trump is the peace candidate.

— Daniel Baldwin (@baldwin_daniel_) July 20, 2023

TAKE A LISTEN

False Flags

Study that found COVID shots killed people … is killed!

- A new study, conducted by respected medical researchers and published in The Lancet, a renowned medical journal, indicated that the COVID shots themselves actually killed people – and the study now has been killed.

- That’s according to a report from Liberty Counsel, which has been one of the key fighters in court against the Biden administration’s various COVID shot mandates during the pandemic.

- The report said the “bombshell” study was done by Dr. Peter McCullough and others and was published in The Lancet.

- But it “was quickly censored within 24 hours after its publication because it showed clear evidence that the COVID-19 shots were responsible for many deaths.”

- Of the 325 autopsies reviewed, “the study revealed the COVID shots directly caused or significantly contributed to up to 74% of those deaths.”

- Overall, COVID is estimated to have killed about seven million around the globe.

- The study was called, “A Systematic Review of Autopsy Findings in Deaths After COVID-19 Vaccination,” and it was on the Lancet in a “pre-print” site on July 5, a start to a months-long peer review proceed.

-

Are world governments trying to keep mortality from COVID shots a secret?

- But less than 24 hours, it was gone. The Lancet claimed there were “screening criteria” issues.

- The report said McCullough, a renowned internist, epidemiologist and “one of the most published cardiologists in American with more than 1,000 peer-reviewed publications,” did the study with eight other researchers.

Source: wnd.com

ok … that was an odd coincidence. 😮 https://t.co/v6EpKEOWEl

— Wall Street Silver (@WallStreetSilv) July 23, 2023

Q

Trump is asked if he’s thought about RFK Jr. as a running mate: “No, but people have suggested it… there are a lot of people suggesting it… I’ve known him over the years. He’s a smart guy and well-intentioned.”

That definitely didn’t sound like it’s out of the question 🤔 pic.twitter.com/QKEj6kUY9V

— Patri0tsareinContr0l (@Patri0tContr0l) July 21, 2023

- Every State should withdraw from ERIC, NOW. It is a disaster for Republicans!

-

RSBN@RSBN

- Texas is withdrawing from ERIC voter roll system

rsbnetwork.com/news/texas-is-w -

Texas is withdrawing from ERIC voter roll system

Photo: Adobe Stock The great state of Texas is poised to withdraw from the Electronic Registration Information Center (ERIC), according to a letter from the office of Texas Secretary of State Jane Nelson…

Right Side Broadcasting Network (RSBN)

- Texas is withdrawing from ERIC voter roll system

-

Donald J. Trump ReTruthed

Runbeck magically "predicted" the push for mail-in ballots because all these "private" election companies are really just arms of the national security state (CIA, DHS, DoD). https://t.co/MXBNaJkEPq

— Emerald Robinson ✝️ (@EmeraldRobinson) July 23, 2023

A must read for everyone in Arizona and the United States interested in unraveling the election fraud. Neither Maricopa County nor it's elections department Runbeck can account for where they got almost 85,000 ballots in the 2022 election. This complete failure of chain of…

— Bryan Blehm (@BlehmLawAZ) July 23, 2023

custody on behalf of Maricopa County and its elections department Runbeck clearly demonstrates that the election of 2022 must be invalidated.

Marc Elias travels state to state destroying election integrity.

Now he's turned his sights to Arizona.

Marc knows the minute we return to handcounts they won't be able to get away with rigging the machines anymore.

That's why we're going to do it.

Bring it on, Marc. pic.twitter.com/XlZDkxuqx0

— Kari Lake (@KariLake) July 22, 2023

BREAKING: FBI told Twitter Hunter Biden laptop was LEGIT hours after NY Post’s bombshell in 2020

- Joe Biden falsely suggested that the incriminating documents were Russian disinformation.“Somebody from Twitter essentially asked whether the laptop was real. And one of the FBI folks who was on the call did confirm that, ‘yes, it was,’ before another participant jumped in and said, ‘no further comment,’” Laura Dehmlow, section chief of the FBI’s Foreign Influence Task Force, recollected in a closed-door deposition Monday, according to a release from the Republican-led committee

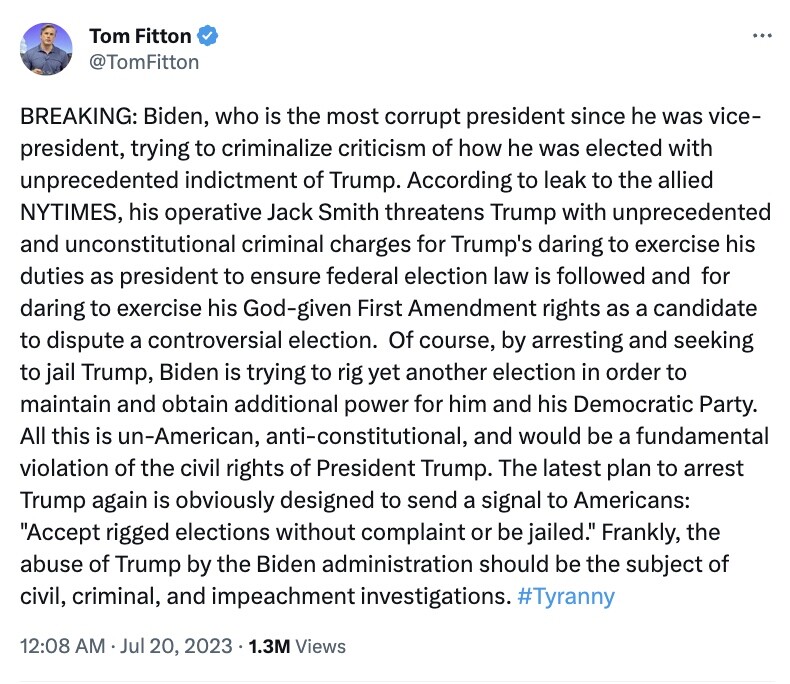

- Special Counsel Jack Smith appears to be drawing closer to an expected indictment of former President Donald J. Trump over contesting the results of the 2020 election.

- The Georgia Supreme Court last week denied Trump’s request to suppress the special grand jury report, and Willis has hinted that any charges might be filed by September 1.

Source: beckernews.com

Donald J. Trump@realDonaldTrump

- U.S. District Judge Aileen Cannon’s decision to schedule former President Donald Trump’s trial for May of next year received a warm response from the Republican’s team on Friday.

- Cannon determined that the trial would start May 20, 2024.

- Trump currently stands as the clear front runner for the party nomination.

Source: justthenews.com

![Ep 3121a - [CB] Is Preparing [CBDC],People Are Ready To Push Back,Sometimes You Must Show The People](https://x22report.com/wp-content/uploads/2023/07/youtube_financial_server-300x169.jpg)

Pingback: Death Penalty To Women/Child Traffickers, The Lion Is Awake,The Strikes Will Be Hard & Fast – Ep. 3121 - Republic Alert

Pingback: Death Penalty To Women/Child Traffickers, The Lion Is Awake,The Strikes Will Be Hard & Fast – Ep. 3121 - x22report - FullDisclosure.news

Still a hell of a lot of people hypnotized by the Fake Media. I would have hoped the Greatest Military Intelligence Operators of Our Time could have brought those lying sons-of-bitches down a bit quicker???

Indeed. Cluster bombs are not technically a ‘war crime’ but they are more or less useless against defensive positions such as those manned by Russia in Ukrine. They will leave nasty little bombs scattered about which are not good for pedestrians, light vehicles, bicycles, etc. But the Russians have them, know how they work, and how to respond/counter them.

As for Gen X being confused over gender, they are mostly the ‘idiot generation’ and I wouldn’t take what they say at face value. Remeber there are numerous polls, numerous surveys, where their answers to basic questions are so inane as to render the answer meaningless. They simply parrot what they generally believe the person asking wants to hear – who know what they believe, if anything. I spent 15 years trying to teach US History (lower division, college courses) to these ‘people’. Frustrating waste of time, for the most part.

Why is it that all anybody talks about is impeaching these different officials when all you need to do to get rid of them is fire them due to non-compliance with their oath of office not being signed or notarized as required by law. A verbal oath without those things nullifies the oath and it becomes non-constitutional.