The [DS]/[D]s Have Lost Control,Patriots In Control,Did Trump Just Hint At Something?Boom – Ep. 2963

Podcast: Download (Duration: 1:08:56 — 30.7MB)

Watch The X22 Report On Video

![The [DS]/[D]s Have Lost Control,Patriots In Control,Did Trump Just Hint At Something?Boom](https://x22report.com/wp-content/uploads/2023/01/youtube_website_01032023_2.jpg)

Economy

- Inflation has been top of mind over the last year, looming over every aspect of the economy. But how has inflation actually impacted the prices of everyday goods like bread and butter or gas and public transportation?

- In this infographic, Visual Capitalist’s Avery Koop and Bhabna Banerjee showcase select items and how inflation has impacted the price year-over-year. Additionally, we’ve charted the overall price increases across the overarching goods categories, using data from the U.S. Bureau of Labor Statistics (BLS).

- How Much has the Cost of Goods Gone Up?

- Inflation has caused the cost of many goods to increase significantly compared to last year. The most dramatically affected item is elementary school lunches, a cost in the U.S. that is already unaffordable for many families.

- Here’s a look at every single reported good’s change in price from last year:

| Item | Unadjusted Change YoY (Nov 2021 – Nov 2022) |

|---|---|

| Food at elementary and secondary schools | +254.1% |

| Food at employee sites and schools | +110.1% |

| Fuel oil | +65.7% |

| Eggs | +49.1% |

| Margarine | +47.4% |

| Other motor fuels | +43.3% |

| Fuel oil and other fuels | +41.7% |

| Airline fares | +36.0% |

| Butter and margarine | +34.2% |

| Butter | +27.0% |

| Flour and prepared flour mixes | +24.9% |

| Public transportation | +23.8% |

| Other dairy and related products | +22.4% |

| Fats and oils | +21.8% |

| Canned fruits | +20.9% |

| Crackers, bread, and cracker products | +19.9% |

| Salad dressing | +19.9% |

| Lettuce | +19.8% |

| Motor oil, coolant, and fluids | +19.6% |

| Frozen and refrigerated bakery products, pies, tarts, turnovers | +19.4% |

| Cookies | +19.2% |

| Lunchmeat | +18.4% |

| Canned fruits and vegetables | +18.4% |

| Frozen vegetables | +18.3% |

| Other uncooked poultry including turkey | +17.9% |

| Cakes, cupcakes, and cookies | +17.6% |

| Ice cream and related products | +17.5% |

| Rice, pasta, cornmeal | +16.8% |

| Cereals and cereal products | +16.6% |

| Other bakery products | +16.5% |

| Cereals and bakery products | +16.4% |

| Dairy and related products | +16.4% |

| Bakery products | +16.3% |

| Other meats | +16.2% |

| Potatoes | +16.2% |

| Canned vegetables | +16.2% |

| Olives, pickles, relishes | +16.1% |

| Processed fruits and vegetables | +15.8% |

| Bread | +15.7% |

| Pet food | +15.7% |

| Fresh milk other than whole | +15.6% |

| White bread | +15.5% |

| Bread other than white | +15.5% |

| Utility (piped) gas service | +15.5% |

| Roasted coffee | +15.2% |

| Other fats and oils including peanut butter | +15.2% |

| Soups | +15.0% |

| Motor vehicle repair | +15.0% |

| Frozen fruits and vegetables | +14.9% |

| Fresh biscuits, rolls, muffins | +14.8% |

| Milk | +14.7% |

| Coffee | +14.6% |

| Other miscellaneous foods | +14.6% |

| Fresh cakes and cupcakes | +14.4% |

| Stationery, stationery supplies, gift wrap | +14.3% |

| Energy services | +14.2% |

| Transportation services | +14.2% |

| Rice | +14.1% |

| Sugar and sugar substitutes | +14.1% |

| Household paper products | +14.1% |

| Apparel services other than laundry and dry cleaning | +14.1% |

| Frozen and freeze dried prepared foods | +14.0% |

| Instant coffee | +13.9% |

| Other food at home | +13.9% |

| Delivery services | +13.8% |

| Fresh whole chicken | +13.7% |

| Beverage materials including coffee and tea | +13.7% |

| Sauces and gravies | +13.7% |

| Electricity | +13.7% |

| Vehicle accessories other than tires | +13.7% |

| Health insurance | +13.5% |

| Frankfurters | +13.4% |

| Motor vehicle insurance | +13.4% |

| Breakfast cereal | +13.3% |

| Nonalcoholic beverages and beverage materials | +13.2% |

| Nonfrozen noncarbonated juices and drinks | +13.2% |

| Poultry | +13.1% |

| Fresh whole milk | +13.1% |

| Sugar and sweets | +13.1% |

| Energy | +13.1% |

| Pets and pet products | +13.0% |

| Juices and nonalcoholic drinks | +12.9% |

| Candy and chewing gum | +12.9% |

| Other foods | +12.9% |

| Carbonated drinks | +12.8% |

| Tools, hardware and supplies | +12.8% |

| Other sweets | +12.7% |

| Cheese and related products | +12.4% |

| Oranges, including tangerines | +12.4% |

| Gasoline, unleaded premium | +12.4% |

| Housekeeping supplies | +12.4% |

| Motor vehicle body work | +12.4% |

| Energy commodities | +12.2% |

| Other beverage materials including tea | +12.1% |

| Food at home | +12.0% |

| Chicken | +12.0% |

| Miscellaneous household products | +11.9% |

| Vehicle parts and equipment other than tires | +11.8% |

| Household cleaning products | +11.7% |

| Motor vehicle maintenance and repair | +11.7% |

| Fresh and frozen chicken parts | +11.6% |

| Motor vehicle parts and equipment | +11.6% |

| Food from vending machines and mobile vendors | +11.5% |

| Snacks | +11.1% |

| Spices, seasonings, condiments, sauces | +11.1% |

| Veterinarian services | +11.0% |

| Baby food | +10.9% |

| Pet services including veterinary | +10.9% |

| Motor fuel | +10.8% |

| Miscellaneous personal goods | +10.8% |

| Gasoline, unleaded midgrade | +10.7% |

| Food | +10.6% |

| Other processed fruits and vegetables including dried | +10.4% |

| Living room, kitchen, and dining room furniture | +10.3% |

| Tires | +10.3% |

| Floor coverings | +10.2% |

| Gasoline (all types) | +10.1% |

| Tools, hardware, outdoor equipment and supplies | +10% |

| Gasoline, unleaded regular | +9.8% |

| Fruits and vegetables | +9.7% |

| Fresh vegetables | +9.6% |

| Fresh sweetrolls, coffeecakes, doughnuts | +9.5% |

| Citrus fruits | +9.5% |

| Prepared salads | +9.5% |

| Hair, dental, shaving, and miscellaneous personal care products | +9.3% |

| Motor vehicle maintenance and servicing | +9.3% |

| Tax return preparation and other accounting fees | +9.1% |

| Full service meals and snacks | +9.0% |

| Purchase of pets, pet supplies, accessories | +8.9% |

| Video discs and other media | +8.9% |

| Frozen fish and seafood | +8.8% |

| Women’s underwear, nightwear, swimwear, and accessories | +8.6% |

| Food away from home | +8.5% |

| Dishes and flatware | +8.5% |

| Outdoor equipment and supplies | +8.4% |

| Household furnishings and supplies | +8.3% |

| Fresh fruits and vegetables | +8.0% |

| Wine away from home | +7.9% |

| Rent of primary residence | +7.9% |

| Laundry and dry cleaning services | +7.9% |

| Ham | +7.8% |

| Dried beans, peas, and lentils | +7.8% |

| New cars | +7.8% |

| Breakfast sausage and related products | +7.7% |

| Processed fish and seafood | +7.7% |

| Beer, ale, and other malt beverages at home | +7.7% |

| Ham, excluding canned | +7.6% |

| Other goods | +7.5% |

| Apples | +7.4% |

| Other fresh vegetables | +7.4% |

| Personal care products | +7.4% |

| Pet services | +7.4% |

| Admission to movies, theaters, and concerts | +7.4% |

| Frozen noncarbonated juices and drinks | +7.3% |

| Medical equipment and supplies | +7.3% |

| Rental of video discs and other media | +7.3% |

| New vehicles | +7.2% |

| Rent of shelter | +7.2% |

| New trucks | +7.1% |

| Music instruments and accessories | +7.1% |

| Alcoholic beverages away from home | +7.1% |

| Shelter | +7.1% |

| Owners’ equivalent rent of residences | +7.1% |

| Owners’ equivalent rent of primary residence | +7.1% |

| Distilled spirits away from home | +7.0% |

| Salt and other seasonings and spices | +6.9% |

| Meats, poultry, fish, and eggs | +6.8% |

| Furniture and bedding | +6.8% |

| Services less energy services | +6.8% |

| Personal care services | +6.8% |

| Haircuts and other personal care services | +6.8% |

| Limited service meals and snacks | +6.7% |

| Shelf stable fish and seafood | +6.6% |

| Fresh fruits | +6.6% |

| Beer, ale, and other malt beverages away from home | +6.6% |

| Garbage and trash collection | +6.6% |

| Fish and seafood | +6.5% |

| Indoor plants and flowers | +6.5% |

| Other personal services | +6.5% |

| Cigarettes | +6.4% |

| Dental services | +6.4% |

| Video discs and other media, including rental of video | +6.4% |

| Men’s suits, sport coats, and outerwear | +6.3% |

| Tobacco and smoking products | +6.3% |

| Miscellaneous personal services | +6.3% |

| College textbooks | +6.2% |

| Legal services | +6.2% |

| All items less food and energy | +6.0% |

| Women’s suits and separates | +5.9% |

| Clocks, lamps, and decorator items | +5.8% |

| Peanut butter | +5.7% |

| Women’s apparel | +5.7% |

| Window and floor coverings and other linens | +5.6% |

| Women’s and girls’ apparel | +5.6% |

| Other fresh fruits | +5.5% |

| Other food away from home | +5.5% |

| Other household equipment and furnishings | +5.5% |

| Newspapers and magazines | +5.5% |

| Alcoholic beverages | +5.5% |

| Tobacco products other than cigarettes | +5.5% |

| Fresh fish and seafood | +5.4% |

| Nonprescription drugs | +5.4% |

| Cosmetics, perfume, bath, nail preparations and implements | +5.4% |

| Recreation services | +5.4% |

| Financial services | +5.4% |

| Sports equipment | +5.3% |

| Educational books and supplies | +5.3% |

| Day care and preschool | +5.3% |

| Other condiments | +5.2% |

| Girls’ apparel | +5.2% |

| Jewelry and watches | +5.2% |

| Watches | +5.1% |

| Jewelry | +5.1% |

| Toys, games, hobbies and playground equipment | +5.1% |

| Club membership for shopping clubs, organizations, or participant sports fees | +5.1% |

| Other linens | +5.0% |

| Other furniture | +5.0% |

| Water and sewer and trash collection services | +5.0% |

| Fees for lessons or instructions | +5.0% |

| Funeral expenses | +4.9% |

| Alcoholic beverages at home | +4.5% |

| Nursing homes and adult day services | +4.5% |

| Water and sewerage maintenance | +4.4% |

| Domestic services | +4.4% |

| Medical care services | +4.4% |

| Photographers and photo processing | +4.4% |

| Other recreation services | +4.4% |

| Residential telephone services | +4.4% |

| Meats, poultry, and fish | +4.3% |

| Video and audio services | +4.2% |

| Postage and delivery services | +4.2% |

| Cable and satellite television service | +4.0% |

| Infants’ and toddlers’ apparel | +3.9% |

| Bananas | +3.8% |

| Propane, kerosene, and firewood | +3.8% |

| Care of invalids and elderly at home | +3.8% |

| Commodities less food and energy commodities | +3.7% |

| Services by other medical professionals | +3.7% |

| Admissions | +3.7% |

| Tomatoes | +3.6% |

| Apparel | +3.6% |

| Recreation commodities | +3.6% |

| Moving, storage, freight expense | +3.5% |

| Elementary and high school tuition and fees | +3.5% |

| Photographic equipment and supplies | +3.3% |

| Other lodging away from home including hotels and motels | +3.3% |

| Recreational reading materials | +3.2% |

| Lodging away from home | +3.2% |

| Hospital and related services | +3.2% |

| Postage | +3.2% |

| Medical care commodities | +3.1% |

| Professional services | +3.1% |

| Intracity transportation | +3.1% |

| Tuition, other school fees, and childcare | +3.1% |

| Wine at home | +3.0% |

| Outpatient hospital services | +3.0% |

| Other appliances | +2.9% |

| Hospital services | +2.9% |

| Bedroom furniture | +2.8% |

| Medicinal drugs | +2.8% |

| Housing at school, excluding board | +2.8% |

| Inpatient hospital services | +2.8% |

| Sporting goods | +2.7% |

| Men’s shirts and sweaters | +2.5% |

| Window coverings | +2.4% |

| Men’s footwear | +2.4% |

| Transportation commodities less motor fuel | +2.4% |

| Checking account and other bank services | +2.4% |

| Men’s apparel | +2.3% |

| Footwear | +2.3% |

| Boys’ and girls’ footwear | +2.3% |

| State motor vehicle registration and license fees | +2.3% |

| Bacon, breakfast sausage, and related products | +2.2% |

| Women’s footwear | +2.2% |

| Education and communication services | +2.2% |

| Photographic equipment | +2.0% |

| College tuition and fees | +2.0% |

| Prescription drugs | +1.9% |

| Recorded music and music subscriptions | +1.8% |

| Eyeglasses and eye care | +1.8% |

| Motor vehicle fees | +1.8% |

| Appliances | +1.7% |

| Distilled spirits at home | +1.7% |

| Whiskey at home | +1.7% |

| Distilled spirits, excluding whiskey, at home | +1.7% |

| Pork chops | +1.6% |

| Other intercity transportation | +1.6% |

| Men’s pants and shorts | +1.5% |

| Physicians’ services | +1.5% |

| Telephone services | +1.5% |

| Audio equipment | +1.4% |

| Other recreational goods | +1.4% |

| Internet services and electronic information providers | +1.4% |

| Men’s and boys’ apparel | +1.3% |

| Pork | +1.2% |

| Meats | +1.1% |

| Women’s dresses | +1.1% |

| Sports vehicles including bicycles | +1.1% |

| Parking fees and tolls | +1.1% |

| Technical and business school tuition and fees | +1.1% |

| Wireless telephone services(1)(2) | +1.0% |

| Sewing machines, fabric and supplies | +0.9% |

| Parking and other fees | +0.9% |

| Nonelectric cookware and tableware | +0.8% |

| Men’s underwear, nightwear, swimwear, and accessories | +0.8% |

| Toys | +0.6% |

| Tenants’ and household insurance | +0.6% |

| Intracity mass transit | +0.4% |

| Laundry equipment | +0.1% |

| Recreational books | 0.0% |

| Uncooked ground beef | -1.0% |

| Major appliances | -1.0% |

| Bacon and related products | -1.1% |

| Boys’ apparel | -1.7% |

| Computer software and accessories | -1.7% |

| Women’s outerwear | -2.0% |

| Used cars and trucks | -3.3% |

| Ship fare | -3.6% |

| Computers, peripherals, and smart home assistants | -4.4% |

| Other pork including roasts, steaks, and ribs | -5.1% |

| Beef and veal | -5.2% |

| Car and truck rental | -6.0% |

| Uncooked other beef and veal | -7.2% |

| Admission to sporting events | -7.2% |

| Uncooked beef steaks | -7.4% |

| Uncooked beef roasts | -8.1% |

| Video and audio products | -8.2% |

| Other video equipment | -9.5% |

| Education and communication commodities | -9.7% |

| Information technology commodities | -11.5% |

| Televisions | -17.0% |

| Telephone hardware, calculators, and other consumer info items | -17.9% |

| Smartphones | -23.4% |

| Household operations | – |

| Gardening and lawncare services | – |

| Repair of household items | – |

| Leased cars and trucks | – |

| All items | +7.1% |

- School lunches became more expensive this year as a federal waiver program came to an end. The program had provided every school child in the country with free lunches.

- After school lunches, fuel oil and eggs rank high in terms of big jumps in their prices, increasing by 66% and 49% respectively. Some other notable increases: airfares have gone up by 36%, living room, kitchen, and dining room furniture by 10.3%, and alcoholic beverages at home by 4.5%.

Source: zerohedge.com

23 States Raised Their Minimum Wage At The Beginning Of 2023

- Minimum wage workers will receive a pay raise in 23 states this year due to minimum wage increases going into effect, according to The Associated Press (AP).

- Wage increases went into effect Jan 1. in Arizona, California, Colorado, Delaware, Illinois, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, Ohio, Rhode Island, South Dakota, Vermont and Washington, AP reported.

- Washington state’s minimum wage grew from $14.49 to $15.74 an hour, the highest of any state and more than twice the $7.25 federal rate. The state will also require job postings to have salary disclosures and other details, according to local outlet K5.

- California’s minimum wage increased to $15.50 an hour, the second highest of any state, as part of a 2017 state law to gradually raise the state’s $10 minimum wage, CBS reported. (RELATED: States Resort To Desperate Measures To Make Up For Pandemic Learning Loss)

- Nebraska’s minimum wage increased from $9 to $10.50 an hour due to a November ballot measure. The state’s minimum wage will gradually increase to $15 an hour by 2026 and adjust for inflation moving forward.

- Maryland’s minimum wage went up from $12.50 to $13.25 an hour and Virginia’s minimum wage went up from $11 to $12 an hour for most employees, Axios reported.

- Connecticut’s minimum wage increase will go into effect June 1. and Nevada’s will begin on July 1. Florida’s wage increase will begin Sept. 30th as part of a gradual increase to $15 an hour passed in a 2020 state referendum, Fox 35 reported.

- The $7.25 an hour federal minimum wage has gone unchanged since 2009, the longest period since the minimum wage was established in 1938, according to the Department of Labor. There are 20 states following the federal rate and 30 states with laws requiring a higher minimum wage.

Source: dailycaller.com

- Why is the Biden Administration so SOFT on China? “The problem the Democrats have with China is that they are soft on China from a domestic policy, jobs, economy, trade, point of view…something that President Trump really understood.” Batya Ungar-Sargon, Newsweek Deputy Opinion Editor, on Maria B (Hey, what’s up with Newsweek? They are getting MUCH better. I guess they found out, like all of the others, that Fake News isn’t working – they’re all going “BUST”). CHINA OWNS BIDEN, and now, the USA!

- I took in hundreds of billions of Dollars from China. Now we are giving it all back! Why? I know!!!

Donald J. Trump@realDonaldTrump

- The “Trump” Tax Cuts MUST BE EXTENDED, OR OUR ECONOMY WILL COME CRASHING DOWN – THE BIG ONE!!!

- One America News Network@OAN

- Norquist: Trump tax cuts’ 5th anniversary shows middle class has saved a bundle rumble.com/v236k0q-norquist-tr #OAN

A Look Ahead at Expiring Tax Provisions

- At the end of 2022 perhaps the most important temporary tax provision will begin to phase out: full expensing for equipment (also known as 100 percent bonus depreciation). This provision will begin to phase out starting December 31st, 2022, at which point the deduction percentage will decrease by 20 percent yearly, resulting in its complete expiration by the end of 2026. Full expensing for equipment is one of the most pro-growth aspects of tax reform, yet temporary implementations fall short of delivering on growth and inevitably cost substantial amounts of revenue.

- The end of September 2022 will mark the expiration of numerous Highway Trust Fund excise taxes. This includes the tax on heavy truck tires, the tax on retail sale of heavy highway vehicles, the reduced rate of tax on partially exempt methanol or ethanol fuels, and all but 4.3 cents-per-gallon of the taxes on highway gasoline, diesel fuel, kerosene, and alternative fuels. On a relatively minor note, the Leaking Underground Storage Tank (LUST) trust fund financing rate will also expire in September of 2022. In 2023, the annual use tax on heavy highway vehicles will also expire. Congress last reached a deal on extending funding for the Highway Trust Fund at the end of 2015, and has yet to propose legislation that permanently appropriates a satisfactory amount of revenue for the Highway Trust Fund. Despite these taxes expiring in 2022 and 2023, it is also unlikely that the Highway Trust Fund remains solvent past the end of FY 2020, warranting a solution before tax provisions expire. It is possible that all taxes related to the Highway Trust Fund could continue to be extended shortly before they expire, but a more permanent source of revenue would be preferable.

- While nothing is currently set to expire in 2024, December 31st, 2025, will be a significant day for most taxpayers. Twenty-three provisions from the Tax Cuts and Jobs Act directly relating to individual income taxes will expire, meaning most taxpayers will see a tax hike unless some or all provisions are extended. Some of the most impactful provisions scheduled to expire include the TCJA’s reduction of individual income rates, increased child tax credit, the increased AMT exemption and phaseout threshold, and the increased standard deduction. The individual income tax code is effectively scheduled to return to what it was before the TCJA, meaning personal exemptions, the overall limitation on itemized deductions, uncapped state and local tax deductions, and many other miscellaneous itemized deductions will return. Despite most of the individual income tax code returning to its pre-TCJA structure, inflation adjustments will continue to be determined by the Chained Consumer Price Index (C-CPI), as set by TCJA, which will result in most taxes increasing when compared to their pre-TCJA levels. Additionally, the qualified business income deduction, which allows pass-through businesses to deduct up to 20 percent of their income, will also expire. For a full list of the twenty-three expiring provisions, consult this JCT publication.

Source: taxfoundation.org

Political/Rights

- Sam Bankman-Fried Asks Judge to Keep His Bail Guarantors Secret

- bloomberg.com/news/articles/2

-

Sam Bankman-Fried Asks Judge to Keep His Bail Guarantors Secret

FTX founder Sam Bankman-Fried asked a judge to keep confidential the identities of two people who will help secure his bail.

- SBF plead Not Guilty today, which is great! I want to see this thing go to trial.

But this is the most interesting bit of the hearing so far IMO…

“…in the next week we anticipate making a large discovery production, including from banks and political campaigns…”

Musk Shreds ‘Scientist’ Paul Ehrlich, Says He Should Have Zero Credibility

- Ehrlich, who has consistently failed to predict the end of the world, spoke on “60 Minutes” Sunday and said “The next few decades will be the end of the kind of civilization we’re used to.”

- Ehrlich has made other notable doomsday predictions, writing in his 1968 book “The Population Bomb” that the 1970s would be hellish and require population control measures to fight overpopulation

- “The battle to feed all of humanity is over,” Ehrlich predicted in the book. “In the 1970s hundreds of millions of people will starve to death.”

- His dire warnings led to the adoption of forced sterilization and other population control measures in various countries, including China’s one-child policy, according to Smithsonian Magazine.

- In 1970 Ehrlich bet that “in 10 years all important animal life in the sea [would] be extinct.” He also wrongly predicted that in 1973, two “smog disasters” in both New York and Los Angeles would claim approximately 200,000 lives.

Source: dailycaller.com

Absolutely

— Elon Musk (@elonmusk) January 2, 2023

- ·“Lawyer claims that the Department of Justice is hiding hundreds of records on Hunter and Jim Biden.” Maria Bartiromo. These records lead to, and implicate, Joe Biden and the many millions of dollars that have been stolen over the years. Why isn’t the Radical Left DOJ, and the Corrupt, Election Changing DBI (Democrat Bureau of Investigation), coming “CLEAN?” After 7 years of investigations on me, and even Spying on my Campaign, they found NOTHING! How about spending some time and effort on Joe?

Geopolitical/Police State

War

US, South Korea In Talks To Cooperate On Nuclear Operations To Ward Off North Korean Threats

- The U.S. and South Korea are discussing ways to cooperate on U.S. nuclear operations amid a perceived need to bolster deterrence against a rising North Korea, U.S. and South Korean officials told Reuters on Tuesday.

- Confirmation of the plans follows South Korean President Yoon Suk-Yeol’s calls for “war preparations” with “overwhelming” capabilities published in a local newspaper Monday, where he mentioned plans to conduct joint nuclear and information sharing exercises, according to Reuters. Both countries see a need to reinforce “extended deterrence” as North Korea escalates military buildup and threatens Seoul’s sovereignty, spurring the need for cooperation on nuclear issues, the outlet reported.

Source: dailycaller.com

False Flags

I don't wish death on anyone!

But why ask for JAIL for those who refuse the vaccine? pic.twitter.com/K14xyCfJFP

— aussie17 (@_aussie17) January 2, 2023

- The NFL basically forces its young, healthy athletes to be vaccinated a disease that has almost zero chance of killing them

- Over 94% of players have received the shot

- Pfizer is a major sponsor of networks that air the NFL

- Do the math

- It was never about health

- It’s about $$$$

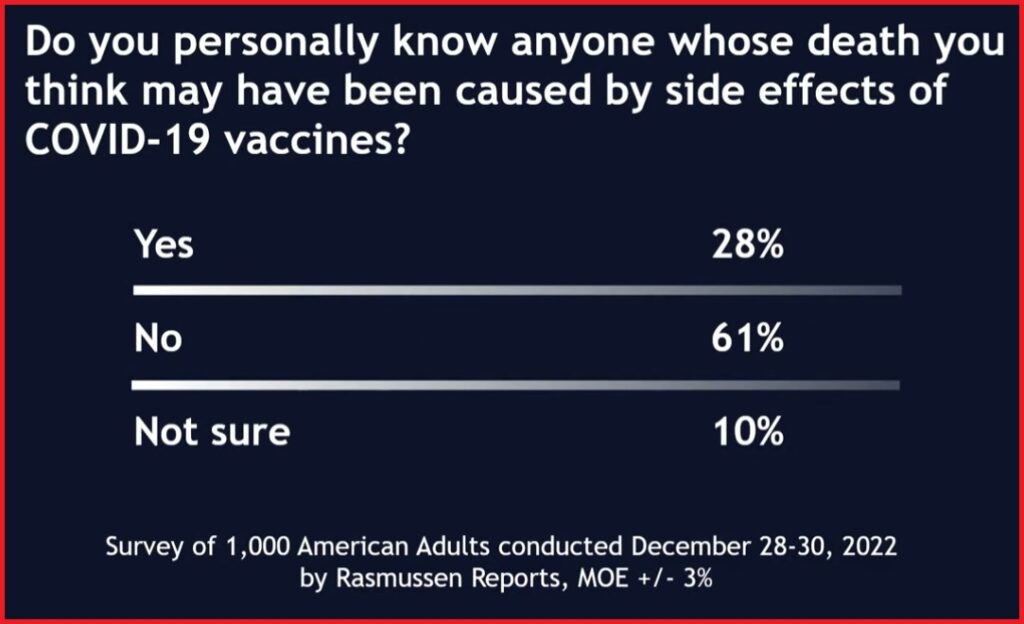

- According to the survey of 1,000 Americans, 28% of the polled respondents know someone personally who died as a side-effect of the COVID-19 vaccination. The results cut across all cultural and political boundaries as reflected in the data. According to Rasmussen, “Twenty-eight percent (28%) of adults say they personally know someone whose death they think may have been caused by side effects of COVID-19 vaccines, while 61% don’t and another 10% are not sure.”

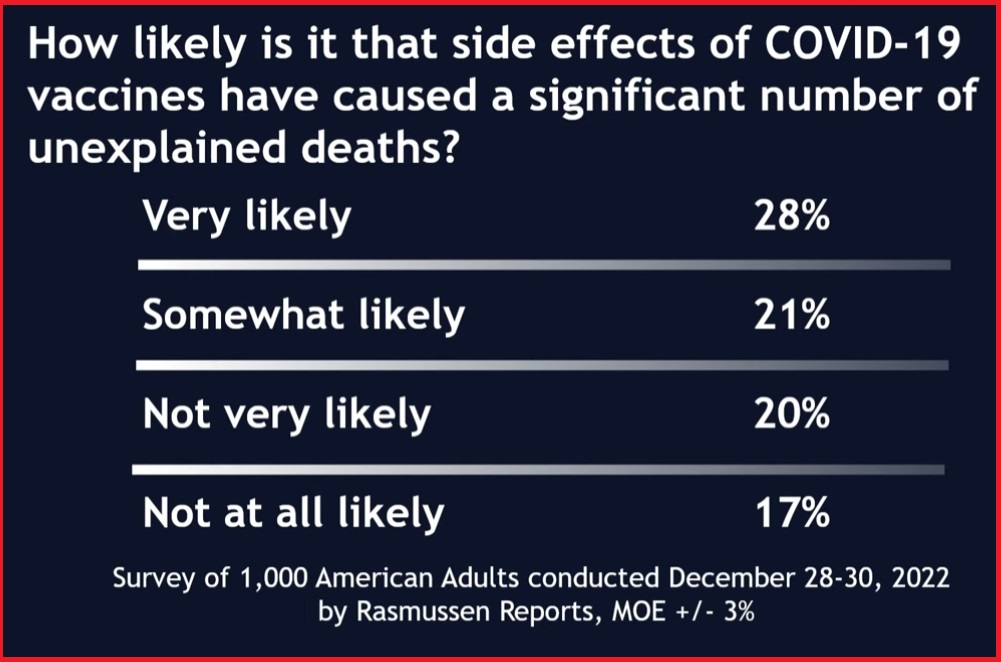

- Forty-eight percent (48%) of Americans believe there are legitimate reasons to be concerned about the safety of COVID-19 vaccines, while 37% think people who worry about vaccine safety are spreading conspiracy theories. Another 15% are not sure. (more)

Source: zerohedge.com

Concerning

— Elon Musk (@elonmusk) January 1, 2023

Q

Ironically, J6 committee didn’t push back on Epps’ narrative that Antifa did it, not him.

Staff and members of the committee so thoroughly beclowned themselves that they sat on the transcribed interview for over a year, and released it only in the final week of their existence.

— Thomas Massie (@RepThomasMassie) January 2, 2023

To clarify: A transcript of their first interview of Epps (over a year ago) and a record of the undisclosed discussions with him between that first interview and this released interview (conducted _almost_ a year ago), have never been made available outside of the committee.

— Thomas Massie (@RepThomasMassie) January 2, 2023

- The newly released transcripts from the Jan 6 Witch Hunt Committee’s interview with Epps show that when asked why he said he could be arrested, Epps falsely claimed that he was trying to “protect” the Trump supporters from “Baked Alaska,” who he accused of trying to “incite violence.” In the video, Baked Alaska is the first person to begin shouting “Fed!” when Epps encourages everyone to go inside the Capitol on Jan. 6.

- The transcript shows Epps and his son have no memory of Epps being called a “Fed.” Epps continually claims that his J6 role was “only trying to protect the police when, on the night of J5, he publicly advocated for people to go into the Capitol.”

- But here’s where things get even more curious—Ray Epp’s attorney’s names are noted in the introduction on the transcript, showing he was represented by John W. Blischak and Andrew Blischak, a father-son duo from Arizona. John Blischak was an FBI agent in Ohio for 9 years before moving to Phoenix, Arizona, where he became an attorney.

- Shortly after, Epps was asked to have his counsel introduce himself, stating his name for the record. Mr. Blischak identified himself, saying, “Yes. My name is John W. Blischak. I will be representing Mr. Epps throughout the course of this investigation.”

- Ray Epps had thousands of attorneys practicing law in Arizona who he could have chosen, but somehow Ray Epps, the man who, without explanation, was removed from the FBI’s “Most Wanted” list in connection with the January 6 “insurrection”

-

- Ray Epps’s attorney Andrew Blischak, son of John Blischak Epps has claimed to be a conservative Trump supporter, but curiously, he hired the Blischaks to represent him, two men who re-tweeted a post supporting the notion that Police should have been able to de-escalate the George Floyd situation. Placing blame on cops instead of criminals is not usually a narrative pushed by conservatives, calling into question Epps’ choice of attorneys.

Source: thegatewaypundit.com

- Katie Hobbs barred reporters from being in attendance to cover her inauguration as governor of Arizona on Monday.

- The Democrat’s team allowed only a single photographer from the Associated Press into the room at the state Capitol while directing others to instead watch the event via live steam, according to local reporter Stacey Barchenger. Media did set up outside of the event.

- A viral clip showed Hobbs laughed while taking the oath of office, which prompted a rebuke from the camp of Arizona Republican gubernatorial nominee Kari Lake, who like other GOP candidates running for statewide office in Arizona has gone to the courts to challenge her 2022 election loss.

Source: dailywire.com

Don't get too comfortable.

You're in @KariLake's chair.

— Kari Lake War Room (@KariLakeWarRoom) January 3, 2023

- Newly uncovered police body cam footage of Ruby Freeman reveal her stunning admissions that directly contradict allegations made under oath by January 6th Committee witnesses, by certain reporters and show hosts, by members of Congress, and by lawyers in sworn statements to Federal Court. Freeman volunteers to blow the whistle on election fraud.

- In the body cam, Ruby Freeman alleges a coverup by the Georgia Secretary of State, the DOJ/FBI, the GBI, and the Fulton County DA.

- 911 call transcript, body cam videos, and police report were obtained by Open Record Requests. From that information investigators have learned that the police report was supplemented in contradiction of the facts.

- Ruby Freeman’s lawyer since January 2021 is Michael Gottlieb who also was lawyer and fixer for Hunter Biden and Aaron Rich, brother to Seth Rich.

- Source: georgiarecord.com

Donald J. Trump@realDonaldTrump

- Wow! Has anyone seen the Ruby Freeman “contradictions” of her sworn testimony? Now this is “BIG STUFF.”Look what was captured by Cobb County police body cameras on January 4, 2021. “And everything they are saying is false. Everything from the quote unquote SUITCASES OF THE BALLOT BOXES, TO THE WHY WE OPENED THEM BACK UP. EVERYTHING THEY SAID WAS FALSE.THE FBI…REACHED OUT TO ME ONLY TO CLEAR MY SOCIAL MEDIA (evidence tampering?)…COUNT WAS LOW, IT WAS REALLY LOW.” Now it gets really bad,TRUTH 2

- Ruby Freeman, page 2: “BOOM under the table. Cut the zip ties to scan them so the number would go up…so that’s how the number was CREATED, by the ballots going through the scanner…I do want an attorney. IT’S ALL A FRAUD. EVERYTHING THEY ARE SAYING IS FALSE. FROM THE SUITCASES OF THE BALLOT BOXES, TO WHY WE OPENED THEM BACK UP. EVERYTHING THEY SAID WAS FALSE.” They got Ruby 7 top D.C. lawyers and protection from the FBI (Again?). WHY? She then “changed” her statements – LIED? TROUBLE FOR RUBY!!!

- What will the Great State of Georgia do with the Ruby Freeman MESS? Why not just tell the TRUTH, get rid of the turmoil and guilt, and take our Country back from the evils and treachery of the Radical Left monsters who want to see America die? MAKE AMERICA GREAT AGAIN!

BOOM!

BOOM!

BOOM!

Q

BREAKING: The AZ Court of Appeals will hear oral arguments on January 4th in the case of AUDIT-USA v. MARICOPA COUNTY, in which AUDIT Elections USA is fighting for the release of ballot images from the November 2020 General Election and future elections. https://t.co/GHvNIf5xUy

— Mr Precedent Slayton (@brandonslayton) January 2, 2023

- The 1st Speaker vote has finished and Kevin McCarthy had 19 Republican No votes

- This is the 1st time this has happened in 100 years

- Quite humiliating for the establishment but a show of strength by the MAGA base

- Trump shared an American Greatness article by Dan Gelernter which suggests that establishment Republicans would do everything in their power to prevent Trump from winning again, and that voters like Gelernter would rather vote for Trump on a third-party ticket even if it means losing the election.

I say no, we don’t knuckle under. And I like DeSantis. I’d vote for him after Trump’s second term. But not before. –American Greatness

- What should we do when a majority of Republicans want Trump, but the Republican Party says we can’t have him? Do we knuckle under and vote for Ron DeSantis because he would be vastly better than any Democrat?

- I say no, we don’t knuckle under. And I like DeSantis. I’d vote for him after Trump’s second term. But not before.

- The Republicans and Democrats appear like the guard rails on either side of the road they’ve decided we should all be traveling on.

- Our best talking-heads and pundits have argued for years that it’s better to win with a bad candidate than to lose with a good one. I used to believe it myself. But look at the results: Until Trump became president, it never even occurred to me that an elected politician could actually do what he’d promised. We’ve been acclimatized to failure, fraud, and theft by the politics of expediency. Year after year, our only choices are “Big Government A” (GOP) or “Big Government B” (Democrat). I used to think Republicans were at least a little more restrained in their spending than the Democrats. But now it’s just clear they spend our money on different things: Democrats give our money to welfare infrastructure (and the drug industry). Republicans give our money to the military-industrial complex (and the drug industry).

- If you ask me, Trump’s presidency was much more “American” than it was “Republican.” That’s why it was such a success and why so many of us loved it. Now, if the Republican Party thinks it’s not big enough for Trump, it’s not going to be big enough for me either.

- Do I think Trump can win as a third-party candidate? No. Would I vote for him as a third-party candidate? Yes. Because I’m not interested in propping up this corrupt gravy-train any longer. Mitch McConnell says that “providing assistance for Ukrainians to defeat the Russians is the number one priority for the United States right now, according to most Republicans.” Most Republicans where? Inside his bank account?

- There are not enough unprintable words in the dictionary to say everything that statements like McConnell’s conjure up in my mind. But here are a few he might understand: “I’m fed up. And I’m out.”

Source: amgreatness.com/

![Ep 2963b - The [DS]/[D]s Have Lost Control,Patriots In Control,Did Trump Just Hint At Something?Boom](https://x22report.com/wp-content/uploads/2023/01/youtube_geo-political_boom-300x169.jpg)

Pingback: The [DS]/[D]s Have Lost Control,Patriots In Control,Did Trump Just Hint At Something?Boom – Ep. 2963 - x22report - FullDisclosure.news

Re AmGreatness: I believe you are on to something there. Better to take control of the existing structure but sometimes that isn’t possible. The Republicans were once a 3rd party (in 1856) but won the next time around.. who knows, maybe.

Dave,

You may wish to invite Matthew Ehret on X22.

Best, Kevin

From The Great Famine To The Great Reset…

Refuting The “Malthusian Pretext” For Genocide

https://www.bitchute.com/video/EbIQQDYst7Gn/?utm_source=substack&utm_medium=email

This Interview With Matt Ehret Is Very Significant

MUST WATCH!!!

“I once knew a dumpster diver – He looked at me and said – `If you don’t give the Soul what It needs, It will destroy the body.”‘ ~ ELM

Pingback: The [DS]/[D]s Have Lost Control,Patriots In Control,Did Trump Just Hint At Something?Boom – Ep. 2963 – MoodMend (M2) Inc.

Pingback: Day 791 Jan 4 2023 – Transformation Michigan – Uniting Michigan in Prayer 83 Counties 24/7 – 365 Days a Year